Recognizing What a Home Loan Broker Does and Just How They Can Benefit You

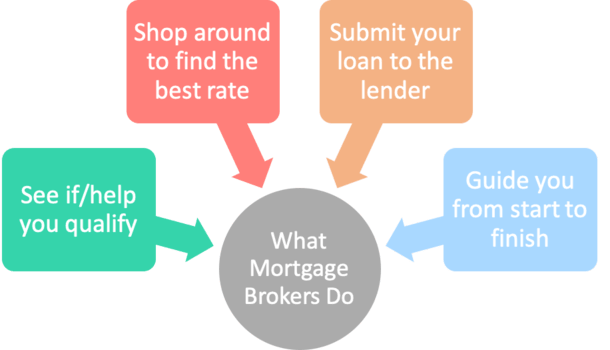

In the intricate world of home financing, recognizing the role of a home mortgage broker can considerably affect your borrowing experience. These specialists serve as crucial middlemans, connecting debtors with suitable loan providers and facilitating a smoother application process. By analyzing private economic profiles, they supply customized recommendations and accessibility to affordable car loan alternatives, which can be particularly helpful for those strange with the mortgage landscape. The complete extent of their services and the possible benefits they offer may not be promptly clear. Discovering these nuances might improve your approach to securing a home loan.

What Is a Mortgage Broker?

A mortgage broker acts as an intermediary between lenders and borrowers, facilitating the lending process by connecting customers with ideal home mortgage alternatives. These experts are experienced and certified in the complexities of the mortgage market, leveraging their competence to discover the finest feasible financing remedies for their customers. Unlike direct lenders, mortgage brokers have accessibility to a large range of car loan products from numerous monetary institutions, allowing them to provide a diverse selection of choices tailored to specific requirements.

Mortgage brokers analyze a debtor's financial scenario, including credit history, revenue, and existing financial obligations, to determine the most proper mortgage products. They play an important role in leading clients via the commonly complex application procedure, ensuring that all needed documentation is finished accurately and submitted promptly. Furthermore, brokers bargain conditions in support of their clients, aiming to secure desirable rates of interest and settlement terms.

Exactly How Home Mortgage Brokers Work

Navigating the home mortgage landscape involves a number of vital steps that mortgage brokers skillfully take care of to improve the procedure for consumers. Brokers examine a customer's economic situation, including income, credit report background, and debt-to-income proportion, to establish suitable mortgage options. This assessment assists them supply customized recommendations that straightens with the consumer's unique needs.

Once the borrower's profile is established, the broker conducts market research to identify lenders that offer competitive prices and desirable terms. Leveraging their developed connections with different loan providers, brokers can access a larger range of mortgage products than a specific consumer may discover on their own. They help with communication in between the consumer and the loan providers, guaranteeing that all essential documentation is gathered and sent precisely and quickly.

Additionally, mortgage brokers overview clients through the details of financing applications, making clear terms and conditions, and resolving any type of issues. They additionally help in working out terms with lending institutions, aiming to secure the ideal feasible deal for the consumer. Ultimately, by taking care of these complicated and frequently taxing tasks, mortgage brokers play an essential function in simplifying the home mortgage process, making it possible for debtors to make informed decisions with self-confidence.

Secret Providers Offered by Home Mortgage Brokers

Mortgage brokers provide an array of key services that improve the loaning experience for clients. One of the main features of a mortgage broker is to evaluate the monetary conditions of clients, including income, credit report history, and financial obligation degrees. This comprehensive assessment enables brokers to advise ideal mortgage products tailored to individual requirements.

Brokers likewise perform marketing research to recognize various car loan choices from various loan providers. By leveraging their considerable network of calls, they can often find competitive rates of interest and beneficial terms that clients may not access separately. Additionally, home loan brokers help with the application process by gathering necessary documentation and ensuring that all paperwork is completed accurately and submitted on time, which aids simplify the authorization procedure.

In addition, brokers provide useful advice throughout the home loan trip, dealing with any type of problems and answering inquiries that arise. They help in browsing intricate financial jargon and can aid customers understand the ramifications of various mortgage choices. mortgage broker san Francisco.

Advantages of Making Use Of a Mortgage Broker

Exactly how can property buyers simplify the typically frustrating procedure of securing a home loan? One efficient remedy is to enlist the services of a home loan broker. These specialists act as intermediaries between debtors and lending institutions, providing vital competence that can enhance the home mortgage procedure.

Among the key advantages of making use of a home mortgage broker is accessibility to a broader series of loan items. Brokers function with numerous lending institutions, permitting buyers to contrast different home loan choices tailored to their financial situation. This can lead to more affordable rates of interest and positive terms.

Furthermore, home mortgage brokers typically have actually established partnerships with lenders, which can assist in quicker authorizations and a more effective closing procedure. Their competence can be specifically advantageous for new homebuyers who might be not familiar with the complexities of protecting a home mortgage. Overall, using a home mortgage broker can make the trip to homeownership more easily accessible and much less challenging.

Selecting the Right Home Mortgage Broker

Selecting the right home loan broker is important to making certain a smooth and successful homebuying experience. To begin, think about the broker's certifications and experience. Seek qualified professionals who have a strong record in the industry, as this can considerably influence the high quality of solution you get.

Following, review the broker's array of lending institutions and mortgage items. An excellent broker should have access to a selection of lending institutions, allowing them to offer you with numerous funding choices customized to your requirements. This diversity can result in better terms and prices, inevitably conserving you cash.

Furthermore, communication is essential. Choose a broker who is receptive and puts in the time to clarify your alternatives clearly. This transparency helps develop count on and ensures you are educated throughout the procedure.

Final Thought

A home mortgage broker acts as an intermediary in between consumers and lending institutions, assisting in the funding procedure by linking clients with suitable mortgage alternatives.Home mortgage brokers examine a debtor's monetary situation, including credit rating ratings, revenue, and existing financial obligations, to figure look at this now out the most suitable mortgage items.Browsing the mortgage landscape involves numerous crucial steps that home mortgage brokers adeptly handle to streamline the procedure for debtors. Ultimately, by handling these facility and typically time-consuming jobs, home loan brokers play an essential click this site duty in simplifying the mortgage procedure, enabling consumers to make educated decisions with confidence.

In conclusion, home mortgage brokers play an essential function in facilitating the home funding procedure by acting as intermediaries in between loan providers and customers.